It might feel like a recession is imminent. Given runaway inflation, rising interest rates, and sinking investor confidence, 2022 has all of the hallmarks of a recession on the horizon. However, recessions come in all shapes and sizes and the truth is that many recessions are not announced retroactively, meaning that we are already in a recession by the time one is announced.

Whether or not a recession is coming – and how mild or bad it may be – has investors wondering what they should do, if anything, to protect their financial lives against a downturn.

As a fiduciary financial advisor, I take a slightly different perspective than economists. Market volatility is expected and normal, especially considering that we are now just getting back to “normal” following a global pandemic. How investors fare in the face of anticipated market uncertainty all depends on how they respond.

Here are seven possible actions investors can take when a recession seems likely:

1. Review your financial plan.

Long-term investors with a documented financial plan may be able to simply stick to their financial plan. When you have a plan for your money, it should be constructed to protect your money against downturns. Market volatility is assumed in a financial plan. Therefore, when volatility shows up, it does not mean all plans should be abandoned. Review your financial plan to make sure that assumptions and goals are still valid. If so, you may have to do nothing more.

What we know from history is that, historically, after markets decline, they rebound. Therefore, it isn’t a question of if the markets recover from a downturn, but when and how much.

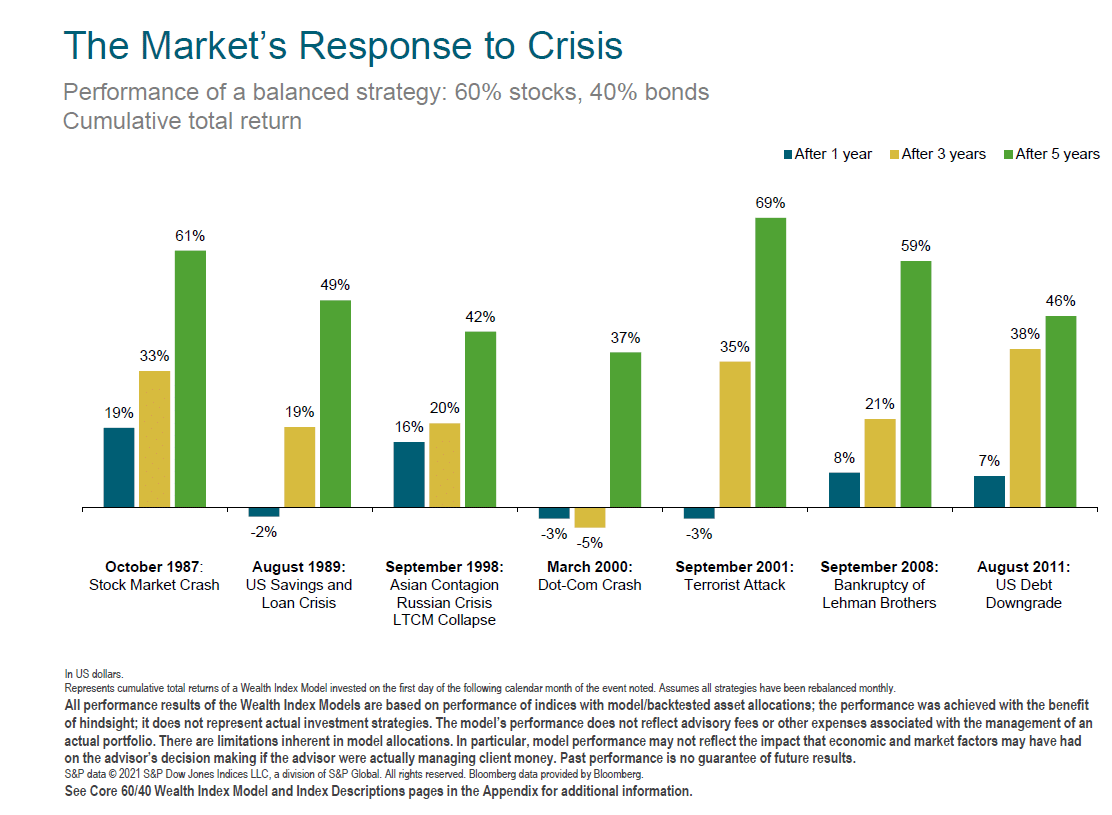

A balanced strategy as illustrated below shows that historically, portfolios have returned to positive performance within 3 years. Therefore, long-term investors with a plan should have confidence they can ride out any short-term declines and expect it will get better.

To access descriptions and disclosures regarding the above chart click here for the attachment.

2. Rebalance your portfolio.

A smart action long-term investors can take is to rebalance their portfolios when necessary. Part of a financial plan assumes an investment portfolio sticks to a target asset allocation.

As the market moves, a portfolio may move out of target. The significance of rebalancing your portfolio is to remain within your risk tolerance so that you don’t inadvertently take on more risk than you are comfortable with that could undermine your future financial security. You also do not want to take too little risk.

3. Tax-loss harvest.

A down market may present an opportunity to capture (realize) some losses to offset other income you may have or income in the future. You have to act quickly though as those losses may not be in existence for too long in a very volatile market.

The strategy is that taking a loss now can mean you reduce your taxable capital gains now or in the future. It’s simple and effective, but timing is everything.

4. Roth conversions.

With market values down, it may be a good time to consider converting some or all of your tax-deferred accounts to a ROTH IRA. By converting pre-tax assets to a Roth when values are down, investors may pay less in taxes on the conversion. The assumption is that the market will recover and the tax-free savings in a Roth can provide tax savings for investors in retirement.

This is true whether we are headed toward a recession or not. Having tax-free buckets of retirement income may be useful no matter what.

5. Save cash in FDIC-insured high-yield savings accounts and CDs.

If you need cash within the next 12-18 months, you may not want those funds invested in the stock market (equities) where you won’t want to access them in a declining market. But, you do not want it sitting in cash earning nothing.

In today’s economic environment, FDIC-insured high-yield savings accounts offer a great way to earn some interest on the money you may need readily accessible. You can find out current rates for savings accounts and CDs at Bankrate.com.

6. Invest in I bonds.

I bonds can be a worthwhile savings vehicle on cash you don’t need access to for a minimum of five years. They don’t fully mature for 30 years, but you can redeem them after one year but will give up the last three months of interest when they’re cashed in within the first five years of purchase.

I bonds are inflation-proof and offer a guaranteed rate of return. Bonds purchased through October 2022 are offering a 9.6 percent return. The purchase of I bonds is limited annually to $5,000 for paper bonds and $10,000 for electronic bonds.

7. Consult with a financial advisor.

When it comes to your finances, consult with your financial advisor if you are uncertain or anxious about the best moves to make with your money. You don’t need to go it alone or blindly make financial decisions without a firm understanding of how one decision can affect other areas of your present and future financial situation.

As we continue to navigate a tumultuous financial landscape impacted by geopolitical events and domestic policies, having a sound financial resource that takes advantage of time-sensitive opportunities can be one of the best moves smart investors are making with their money right now.